While the Board of Trustees hasn’t approved any cost of living increase to our Teachers’ Pension yet, the Canadian Consumer Price Index showed an increase of 1.6%, year over year, for the month of September. Since we know that the Inflation Adjustment Account has a healthy balance we can predict that our pensions will be increased by 1.6% beginning at the end of January. And once cost of living increases have been made they become part of our guaranteed pension.

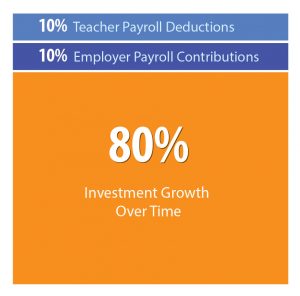

How is it possible that our pension is in a healthy, sustainable position when the government and news reports that Defined Benefit Plans, like our, are unsustainable? Active teachers and their School boards contribute sufficient funds during the active member’s career. When that money is invested prudently over the life time of each member it becomes enough to pay the lifetime pension. You might be surprised to know that about 80% of the pension money you receive comes from investment income. About 10% for your pension is your original contribution coming back, about 10% is your employer’s contribution coming back, but the huge majority of your pension is investment returns. Our pensions are not subsidized by the taxpayers.

Interestingly, another Defined Benefit Pension Plan – The Canadian Pension Plan – has recently been shown to be sustainable for the next 75 years.

Sustainability of the CPP has been examined in this report: http://www.cppib.com/documents/1457/CPPIB_Sustainability_Backgrounder_Nov2016EN.pdf

So why is Bill C-27 still on the agenda of the federal government? Read https://bcrta.ca/target/